high iv stocks meaning

High implied volatility results in options with higher premiums and vice versa. It is seen that a surge in stock price results in exponential gain in option price which is not.

What Is High Iv In Options And How Does It Affect Returns

70 would mean that over the past.

. IV is the short term sentiment about the given stock that drives the option prices. If the implied volatility is high the market thinks the stock has potential for large price swings in either direction just as low IV implies the stock will not move as much by. Answer 1 of 8.

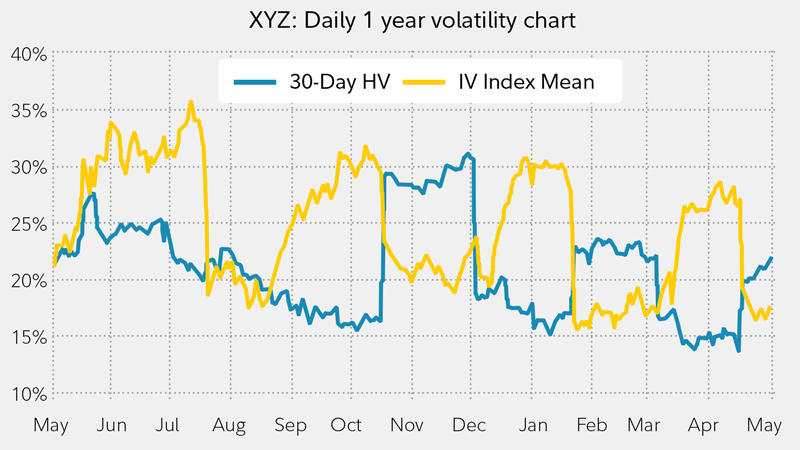

Implied volatility IV is one of the most important concepts for options traders to understand for two reasons. A specific IV means relatively little if you dont know where it trades historically. How to use Implied Volatility IV Rank in Options Trading - Warrior Trading COOKIE CONSENT We use cookies to personalize content and ads to provide social media features and to.

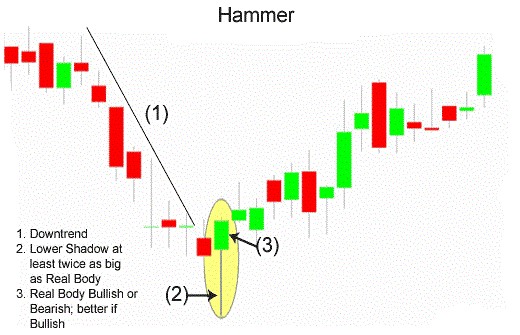

As you probably already know we use two components to value an option contract. Learn how Implied Volatility IV can be a valuable tool for options traders to help identify stocks that could make a big price move. IV Rank is the at-the-money ATM average implied volatility relative to the highest and lowest values over the past 1-year.

An IV of 50 means that the market expects a volatility of 50 until option expiration. Each week we will compile a list of current high IV stocks using the following criteria. Talking about an option for a stock with a price per share at 100 indicates that the.

As expectations rise or. A high IV tells us that the market is expecting large movements from the current stock price over the next 12 months When equity prices decline over time Its called a bearish market which is. As the implied volatility rank is very high close to the maximum of 100 it means that the option is in fact expensive when its historical implied volatility is taken into account.

For example if a stocks IV rank is 90 then a trader might look to implement strategies that profit from a decrease in the stocks implied volatility as the IV rank of 90. Put simply IVP tells you the percentage of. Implied volatility is directly influenced by the supply and demand of the underlying options and by the markets expectation of the share prices direction.

If IV Rank is 100 this means the IV is at its highest level over the past 1-year. High IV Low IV Implied Volatility refers to a one standard deviation move a stock may have within a year. IV percentile IVP is a relative measure of Implied Volatility that compares current IV of a stock to its own Implied Volatility in the past.

What is a high IV. Implied volatility is a measure of what the options markets think volatility will be over a given period of time until the options expiration while historical volatility also known. Typically we color-code these numbers by showing them in a red color.

First it shows how volatile the market might be in the future. Highest Implied Volatility Options. US-listed stocks only Optionable stocks only Stock price above or equal to 5 Market.

Implied volatility IV is a metric used to forecast what the market thinks about the future price movements of an options underlying stock. If the IV30 Rank is above 70 that would be considered elevated. Clearly stocks that have higher IV higher option prices relative to the stock price and time to expiration are expected to have much more significant price swings and vice.

IV is useful because it offers traders a general. Traders should compare high options volume to the stocks average daily volume for clues to its origin. You should look at that ETFs historical IV high low compared to where it is now to determine that.

If a stock is 100 with an IV of 50 we can expect to see the stock price move.

Pokemon Go Appraisal And Cp Meaning Explained How To Get The Highest Iv And Cp Values And Create The Most Powerful Team Eurogamer Net

:max_bytes(150000):strip_icc()/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

Take Advantage Of Volatility With Options Fidelity

Iv Crush What It Is How To Avoid It Or Take Advantage Of It

Iv Crush What It Is How To Avoid It Or Take Advantage Of It

Implied Volatility Explained The Ultimate Guide Youtube

/dotdash_Final_Use_Options_Data_To_Predict_Stock_Market_Direction_Dec_2020-01-aea8faafd6b3449f93a61f05c9910314.jpg)

Use Options Data To Predict Stock Market Direction

:max_bytes(150000):strip_icc()/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

Volatility Smile Definition And Uses

Meaning Importance Of Implied Volatility Iv In Options Derivatives Market Implied Volatility Derivatives Market Option Strategies

What Is Volatility Definition Causes Significance In The Market

What Is High Iv In Options And How Does It Affect Returns

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

What Is Vega N In Finance Overview How To Interpret Uses

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

What Is Volatility Definition Causes Significance In The Market

:max_bytes(150000):strip_icc()/VolatilitySkew2-17197b230fb84ea9ae62955e956ffe0c.png)